Great news for Dutch homeowners!

Since January 1, 2023, the Dutch government has applied a 0% VAT rate to the supply and installation of solar panel systems on or near residential homes. (e.g., your home, but also on nearby structures like a garage, garden shed, greenhouse, or vacation home). This means as a Dutch resident, you can purchase and install eligible solar energy products without paying VAT, significantly lowering your upfront investment costs.

For comprehensive information on VAT regulations and declaration procedures in the Netherlands, please refer to the official resources provided by the Dutch Tax Authorities

Learn more on the Dutch Belastingdienst website

Installations such as solar panels and energy storage systems that do not meet the criteria for the 0% VAT scheme—for example, those used for commercial activities or sited on non-domestic properties—are subject to the standard VAT rate of 21%.

In most cases, you are eligible to reclaim the VAT through the following channel: Dutch Belastingdienst website

Can I Reclaim VAT for Home Battery? | Check Conditions for reclaiming VAT on home battery

Follow These 5 Steps to Complete Your Tax-free Purchase

Upload Proof of Residential Address

Upload official proof of your residential address to qualify for VAT exemption

Log In to BuyPurchase VAT-free Products

Once your proof of address is uploaded and verified as residential, you will unlock the VAT-free option

Log In to BuyOrder Verification Process

To ensure VAT exemption eligibility, we verify your order details and document authenticity

Log In to BuyOrder Confirmation

Your order has been received and is undergoing final validation to secure your VAT-free purchase.

How It Works

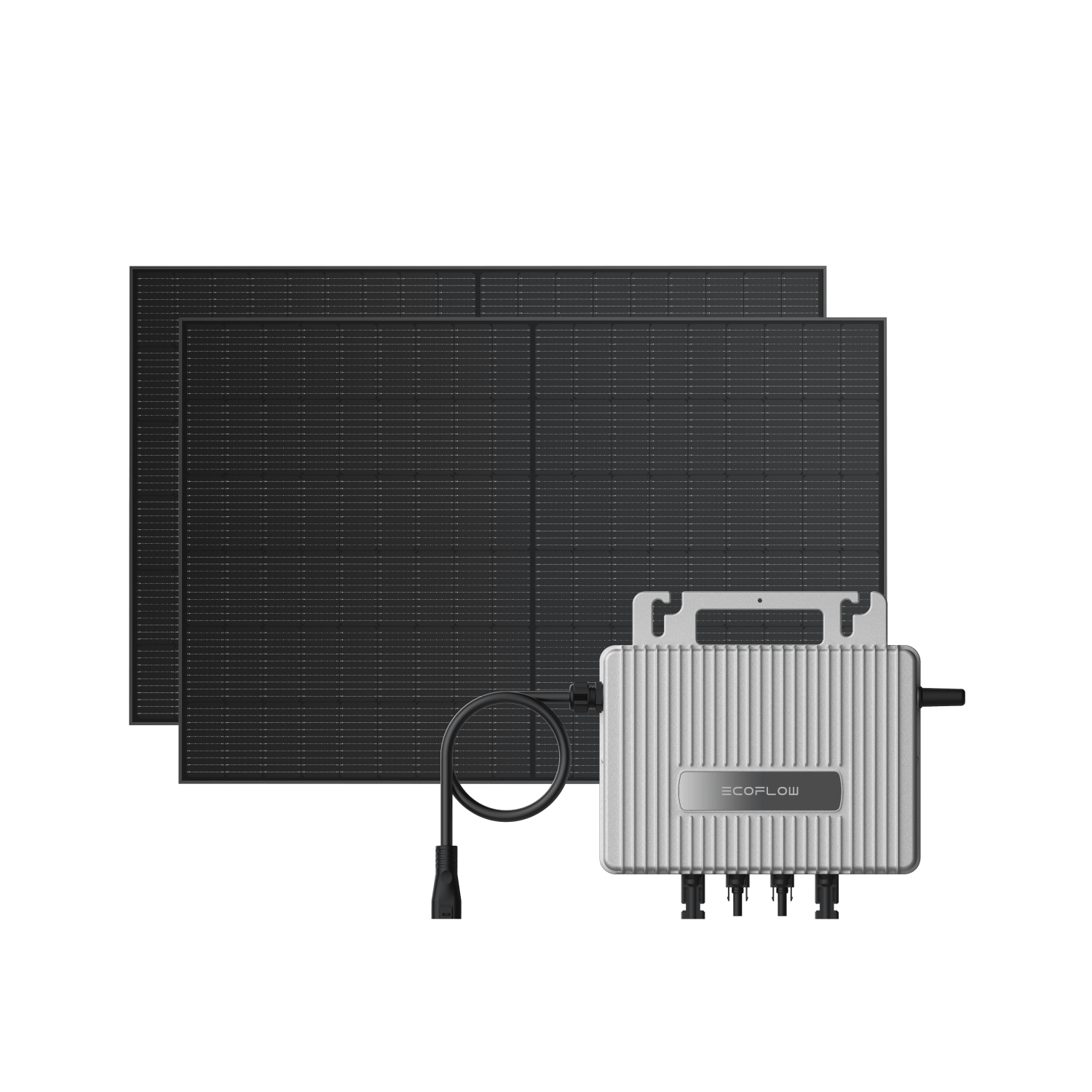

25% Conversion Rate | IP68

Q1: Who is eligible for VAT exemption in the Netherlands?

A: The 0% VAT rate applies to solar energy systems installed on or near residential properties (e.g., homes, garages, sheds). Businesses purchasing for commercial use typically pay standard VAT but may reclaim it later.

Q2: What documents are required to prove eligibility?

A: You will need to provide proof of residential address showing that the installation site qualifies as a dwelling (please visit the official BAG Viewer website https://bagviewer.kadaster.nl to check your address.) The address must match your order details exactly.

Q3: How do I submit my documents for VAT exemption?

A: Swipe up this page to "Follow These 4 Steps to Complete Your Tax-free Purchase" - begin by uploading your proof to access VAT-free pricing.

Q4: What happens if my documents are invalid or don’t match the order address?

A: If the provided documents are invalid or don't match your order address, you will receive an Order Cancellation notice. Your order will be cancelled to comply with Dutch VAT regulations. You will receive a full refund if payment was already made.

Q5: How long does the verification process take?

A: Verification typically takes 1-2 business days after document submission. Approved orders will proceed to shipment immediately.

Q6: Where can I find official information about Dutch VAT policies?

A: For the most accurate and updated details, refer to the official Dutch Belastingdienst website.

Q7: When is 21% VAT charged on solar panels and storage, and can it be reclaimed?

A: Installations such as solar panels and energy storage systems are subject to the standard 21% VAT rate if they do not meet the criteria for the 0% VAT scheme. This typically includes systems used for commercial activities or installed on non-domestic properties. In most cases, you are eligible to reclaim this VAT. The process can be initiated through the Dutch Belastingdienst Website

Q8: Is it possible to reclaim the VAT paid on a home battery?

A: Yes, it is possible to reclaim the VAT for a home battery, but you must check and meet specific conditions. The Dutch Belastingdienst provides a dedicated page to verify the conditions for reclaiming VAT on home battery: